How to install and configure the VAT module

The module VAT for the European Union allows the billing system to comply with the value added tax (VAT) for payers from European Union countries (EU). For more information on the VAT system in the EU, see General Information on VAT.

Module:

- automatically creates tax rates for selected providers, in full accordance with the current rates of the European Union;

- for payers from the EU with the type "Company" and "Sole proprietor" adds the optional parameter "EU VAT number". The indicated VAT number is automatically verified through a specialized service;

- adds an invoice template — EU-credit, adapted for payers from EU countries.

Installation and configuration of VAT module

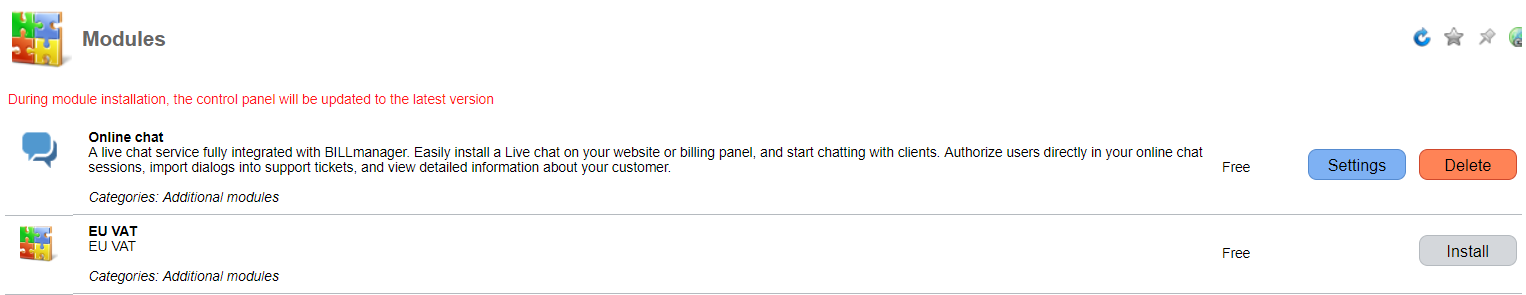

To install the module, go to Integration → Modules → EU VAT → Install.

VAT module

The VAT module can be configured individually for each provider. To adapt your provider's tax system to EU law, go to Integration → Modules → EU VAT → Settings → select the provider → Configure.

Within the framework of automatic configuration, changes in the logic of work with payers will be made.

The settings that will be applied to all providers:

clients will not be able to create payers with different statuses. This means that the client can have a payer either an individual or a company/sole proprietor;

Note:

The corresponding option will be enabled in the section Provider → Global settings → Payers management settings block: Forbid clients to create payers with different statuses. We do not recommend turning it off so as not to disrupt the logic of working with tax rates.

- clients will be able to create only one payer of the type "Company" or "Sole proprietor";

- customers from EU countries with the payer type "Company" and "Sole proprietor" will have the "EU VAT number" field on the payer creation form. This field is not mandatory. If the client specifies a VAT number, the value is checked via the automatic check service;

- an invoice template adapted to the EU payers will be added. The name of the template is EU credit. This template must be specified in the payment method settings manually. Go to Provider → Payment methods → select the provider → Edit and select EU credit in the Print template field. Only verified VAT numbers will be displayed in the invoice.

The settings that will be applied to the selected provider:

Note:

For the BILLmanager Corporate version, alongside with configuration of the VAT module for a separate provider, the module can be configured for separate client groups. In this case, the settings listed below will be applied not to a particular provider, but to the selected groups of clients.

- tax rates will be created according to the European Union rates;

- the Do not include into price option will be enabled.

For example, a provider of shared hosting services has set the tariff rate at €5. As the tax is not included in the price, VAT will be added to the set value. Then for a customer from France the service price including VAT will be €6 (tax rate 20%).

Recommended settings

For the correct assignment of tax rates, we recommend the following settings:

- Disable the option Allow a client to create payers from different countries in Provider → Global settings → Payers management settings block.

If this option is enabled, then when the client has several payers (individuals) from different countries, the price of the goods or services including VAT may be displayed incorrectly. This is due to the logic of assigning a tax rate in BILLmanager. Before the customer selects a specific payer, BILLmanager will display the price of the product or service including VAT for the first (by ID) payer. In addition, if the customer chooses another payer from another country for payment, the price of the goods or services will change.

- Check that your clients' settings meet the recommended requirements:

- if the customer is a company/sole proprietor, it can have only one payer;

- if the client is an individual, it may have multiple payers, but all payers must be from the same country.

If there are already clients with several active payers in BILLmanager that do not meet these requirements at the moment of connecting the VAT module, we recommend that the administrator of the panel manually disable the extra payers. Agree with your clients on disconnecting the payers in advance.

- When setting up the VAT module for a certain provider, follow the logic:

- one EU company corresponds to one provider. To link a company to a specific provider, go to Provider → Companies → select the required company → Providers button → select the required provider → Enable. For other providers, disable the link with the company with the Disable button;

- each payment method is linked to only one company. To link a payment method to only one company, go to Provider → Payment methods → select the required payment method → Companies button → select the required company → Enable. For other companies, disable the link with the method with the Disable button.

For example, in BILLmanager you have providers: "Provider-EU" and "Provider-RUS". You configure the VAT module for "Provider-EU". One company with a valid VAT number must correspond to this provider. For example, you choose the company “Company-EU”. Make sure that no other companies are linked to "Provider-EU" and no other providers are linked to "Company-EU". For "Company-EU" company you link payment methods – Paymaster and PayPal, and for "Company-RUS" company – YooMoney and WebMoney. Several payment methods can be linked. It is only important that the same payment method is not linked to two companies.

- When setting up the VAT module for a certain group of clients, follow the logic:

- each payment method is linked to only one company;

- one EU company and one group of clients correspond to one provider.

- to link a group of clients to one provider and one company, set a limit on the group of clients in payment method settings.

In the above example, you have configured the link "Provider-EU" — "Company-EU" — Paymaster. Now, to configure the link between the company and the "Clients EU" group of clients, go to the Paymaster payment method settings: Provider → Payment methods → Paymaster → Edit → Access permissions settings block → Client groups. Set this parameter to "Clients EU".

Operating principle

In the process of automatic provider configuration, tax rates will be created for all EU countries.

Note:

The administrator of the control panel can manually change the tax rates assigned automatically: Provider → Providers → select the provider → Tax button. You can also change tax rates for a group of clients (when configuring the VAT module for a group of clients): Clients → Client groups → select the group → Taxes.

When using the recommended settings, customers from EU countries will be assigned the correct tax rate. It can be assigned based on several possible scenarios.

Tax rate assignment options

A personal tax rate is applied

The personal tax rate has the highest priority. To assign this rate, go to Clients → select the client → Tax → Add.

If there are no personal tax rates, the tax rate is set according to the scenarios described below.

The tax rate of the payer's country is applied

This rate applies if the payer is:

- an individual;

- a company/sole proprietor with a confirmed VAT number. In case the payer's country is the same as the company's country or the company's country is not an EU member;

a company/sole proprietor with a confirmed VAT number. If the provider has several companies and the payer is not linked to any of them;

Note:

The tax rate assignment option may change after the payment method is selected. If, according to the recommendations, the payment method is linked to one company, BILLmanager determines that the supplier and the buyer companies are in the same country or in different countries. If the companies are from one EU country, the tax rate of that country is applied. If the companies are from different countries, there is no tax (reverse payment mechanism is used).

- a company/sole proprietor from an EU country with an unspecified VAT number. If the VAT number is not specified, then the payer is considered an individual;

- a company/sole proprietor with an unconfirmed VAT number. If the VAT number is not confirmed, the payer is considered an individual.

The tax rate of the client's country is applied

This rate is applied if the payer is not available and an EU country is specified for the client.

No tax

A zero tax rate is applied if:

the payer is a company/sole proprietor with a confirmed VAT number, but the payer is not linked to the company and the provider settings do not specify the country. BILLmanager cannot assign the correct tax rate, and therefore VAT is not assigned.

Note:

The tax rate assignment option may change after the payment method is selected. If, according to the recommendations, the payment method is linked to one company, BILLmanager determines that the supplier and the buyer companies are in the same country or in different countries. If the companies are from one EU country, the tax rate of that country is applied. If the companies are from different countries, there is no tax (reverse payment mechanism is used).

- the payer is a company/sole proprietor from an EU country, and the payer's country and the company's country do not coincide. In this case, according to the European tax law, the supplier of goods/services does not need to charge VAT, as the reverse payment mechanism is used. Read more about this mechanism in General information about VAT.

Note:

If your settings differ from the ones recommended in this article, the number of options for assigning tax rates increases. In some cases, BILLmanager may assign an incorrect tax rate.

Checking the VAT number

The VAT number specified by the customer is automatically checked by a special service. If the number could not be verified, the client can contact the provider through the system of written requests (tickets). An employee of the provider can manually check the VAT number and note that the VAT number is correct on the payer editing form.